November 23, 2010

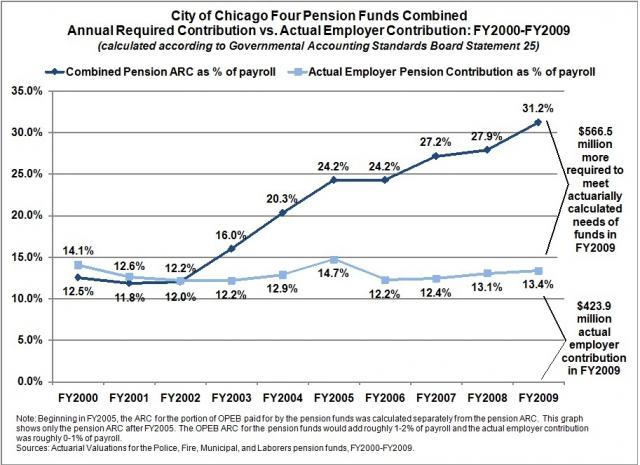

The City of Chicago contributed $423.9 million to its Municipal, Laborers, Police, and Fire pension funds in fiscal year 2009, an amount equivalent to 13.4% of payroll. If it were following a fiscally reasonable pension funding policy it would have contributed at least 31.2% of payroll—an additional $566.5 million. Over the last ten years the cumulative difference between what was actually contributed and what should have been contributed to the four City pension funds is $2.4 billion.

This calculation of what should have been contributed is based on the financial reporting requirements for public pension funds and their associated governments, which are set by the Governmental Accounting Standards Board (GASB).GASB standards require disclosure of an Annual Required Contribution (ARC), which is an amount equal to the sum of (1) the employer’s “normal cost” of retirement benefits earned by employees in the current year and (2) the amount needed to amortize any existing unfunded accrued liability over a period of not more than 30 years. Normal cost is that portion of the present value of pension plan benefits and administrative expenses which is allocated to a given valuation year and is calculated using one of six standard actuarial cost methods. Each of these methods provides a way to calculate the present value of future benefit payments owed to active employees. The methods also specify procedures for systematically allocating the present value of benefits to time periods, usually in the form of the normal cost for the valuation year and the actuarial accrued liability (AAL). The actuarial accrued liability is that portion of the present value of benefits which is not covered by future normal costs.

ARC is a financial reporting requirement but not a funding requirement. The statutorily required City of Chicago contributions to its pension funds are set in the state pension code. However, because paying the normal cost and amortizing the unfunded liability over a period of 30 years does represent a reasonably sound funding policy, the ARC can be used as an indicator how well a public entity is actually funding its pension plan.

Expressing ARC as a percent of payroll provides a sense of scale and affordability. In FY2000 the City’s Municipal Fund ARC was 7.5% of payroll and the actual employer contribution was greater than the ARC, at 11.3% of payroll. The Fund had a strong 94.5% actuarial funded ratio at that time. Ten years later the ARC had risen to 26.6% of payroll while the actual employer contribution was only 9.5% of payroll.

The cumulative ten-year difference between ARC and actual employer contribution for all four City pension funds combined is a $2.4 billion shortfall. In 2009, the combined ARC for the four funds was $990.4 million or more than double the actual employer contribution of $423.9 million. The combined pension and OPEB employer contribution shortfall in FY2009 was $566.5 million.

The graph below illustrates the growing gap between the combined pension ARC of the four funds as a percent of payroll and the actual employer contribution as a percent of payroll. The spread between the two numbers has grown from surplus of 1.5 percentage points, or $37.6 million, in FY2000 to a gap of 17.9 percentage points in FY2009. In other words, to fund the pension plans at a level that would both cover normal cost and amortize the unfunded liability over 30 years the City would have needed to contribute an additional 17.9% of payroll, or $556.5 million, in FY2009.[1]

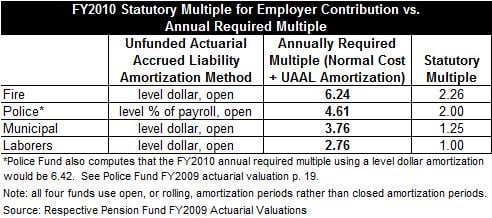

The City of Chicago has consistently contributed its statutorily required amounts of 2.26 times the employee contribution made two years prior for the Fire Fund, 2.0 for the Police Fund, 1.25 for the Municipal Fund and 1.00 for the Laborers Fund. However, these amounts have been less than the ARC for most of the last decade. The pension fund actuaries estimate that in order to contribute an amount sufficient to meet the ARC in FY2010, the City would need to contribute a multiple of 6.24 for the Fire Fund, 4.61 for the Police Fund, 3.76 for the Municipal Fund, and 2.76 for the Laborers Fund.[2]